One other benefit of a gold IRA kit is that it can make it easier to save for retirement. First, it’s vital to grasp that gold IRA kits should not subject to the same taxes as other sorts of retirement accounts. Gold IRAs may also have distinctive tax attributes. Savvy traders have used gold IRA accounts for a number of causes to realize their retirement objectives. Now conversation on the hashtag has turned, inevitably, to how straightforward it is to make use of social media to get people to imagine rumours, and no little despondency about the spate of adverse information this year. If you cherished this short article as well as you would like to be given details with regards to ira gold investment kindly pay a visit to our webpage. The ones you will discover here have B or higher ratings and have extra optimistic opinions in comparison with the destructive ones. Typically, firms get unfavourable and constructive reputations for a selected reason. Discover the completely different sorts of retirement accounts that qualify for the gold IRA rollover in addition to the particular necessities that apply to the various kinds of retirement accounts. This may be finished by contacting the custodian of your present retirement account and requesting a rollover into a gold IRA. The upkeep and storage fees might impact your total returns, so in case you do find yourself making a profit, those upkeep and storage charges lower into internet gains.

One other benefit of a gold IRA kit is that it can make it easier to save for retirement. First, it’s vital to grasp that gold IRA kits should not subject to the same taxes as other sorts of retirement accounts. Gold IRAs may also have distinctive tax attributes. Savvy traders have used gold IRA accounts for a number of causes to realize their retirement objectives. Now conversation on the hashtag has turned, inevitably, to how straightforward it is to make use of social media to get people to imagine rumours, and no little despondency about the spate of adverse information this year. If you cherished this short article as well as you would like to be given details with regards to ira gold investment kindly pay a visit to our webpage. The ones you will discover here have B or higher ratings and have extra optimistic opinions in comparison with the destructive ones. Typically, firms get unfavourable and constructive reputations for a selected reason. Discover the completely different sorts of retirement accounts that qualify for the gold IRA rollover in addition to the particular necessities that apply to the various kinds of retirement accounts. This may be finished by contacting the custodian of your present retirement account and requesting a rollover into a gold IRA. The upkeep and storage fees might impact your total returns, so in case you do find yourself making a profit, those upkeep and storage charges lower into internet gains.

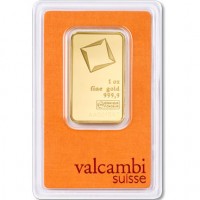

These certificates might be easier to manage than physical gold however usually come with storage and management charges. They supplied a variety of treasured metals for funding, together with gold, silver, platinum, and palladium. In this article, we have put together an inventory of the best Gold IRA companies out there right this moment. In 2023, it’s $6,500 for an individual under 50; if you are over 50, you’ll be able to put in $7,500. Subsequently they create a perverse incentive for them to prioritize this relationship over finding the very best possibility for you as a person investor. In the case of discovering a reputable gold dealer, you may ask for suggestions from mates or household, or you may search on-line. The most direct way to purchase gold is through gold bullion, which is rated by the purity of the gold and comes in the type of coins or gold bars. It is essential to note that while investing in precious metals by means of a Gold Backed 401(k) can present diversification benefits, it additionally comes with prices similar to storage fees and doubtlessly greater transaction prices than traditional investments.

These certificates might be easier to manage than physical gold however usually come with storage and management charges. They supplied a variety of treasured metals for funding, together with gold, silver, platinum, and palladium. In this article, we have put together an inventory of the best Gold IRA companies out there right this moment. In 2023, it’s $6,500 for an individual under 50; if you are over 50, you’ll be able to put in $7,500. Subsequently they create a perverse incentive for them to prioritize this relationship over finding the very best possibility for you as a person investor. In the case of discovering a reputable gold dealer, you may ask for suggestions from mates or household, or you may search on-line. The most direct way to purchase gold is through gold bullion, which is rated by the purity of the gold and comes in the type of coins or gold bars. It is essential to note that while investing in precious metals by means of a Gold Backed 401(k) can present diversification benefits, it additionally comes with prices similar to storage fees and doubtlessly greater transaction prices than traditional investments.

Earlier than making any decisions about who to select as your gold IRA custodian, you will need to weigh all of the prices and benefits of each supplier. These platforms often enable for straightforward buying and selling and low entry costs. E-Gold or Tokenized Gold: With advancements in blockchain expertise, some platforms supply tokenized gold, where each digital token represents ownership of a certain amount of bodily gold. Associated to gold futures contracts are gold options, which permit buyers to purchase a futures contract inside a certain period of time, moderately than just buy a futures contract from the get-go. These might embrace exchange-traded funds (ETFs), gold mining company stocks, precious metallic commodity futures, and gold-oriented mutual funds, all of which have oblique ways to own gold. There are some things it is advisable to do with a purpose to arrange a gold IRA kit. Moreover, an increase in wealth in some market economies boosts demand for gold. Moreover, verify together with your 403(b) plan supplier which investment choices can be found within your account. Can you use funds from a 403(b) to spend money on gold? Traders may use roll-over funds or money from a 401(ok), 403(b), 457(b), or TSP plan. How does it differ from a standard 401(k) or IRA? Nevertheless, with a gold IRA kit, your contributions aren’t tax-deductible. Gold IRAs are separate from different kinds of IRAs.

Advocates of gold IRA investing claim that one in every of the numerous advantages of gold is that it is an efficient hedge. The IRS rules for self-directed IRAs claim that you can not possess the bodily gold or silver yourself. The IRS recognizes varied precious metal coins and gold bullion that meets these requirements. However, it is essential to consider account fees and high quality of service. Professionals drive them and supply diversification, but they include management fees. There are different charges to consider that may come up together with your self-directed Gold IRA. In 14 carat gold, there is 14 components and 10 elements other alloys. A gold IRA kit can profit you in some ways. Please request your free gold IRA kit immediately and get pleasure from the benefits of getting a gold-backed IRA. Request a free gold investment package. Download the FREE Buyer Beware guide and discover ways to avoid deceptive gold IRA sellers. You may discover an IRA firm that provides free providers, however it will not be a reliable possibility.

Please observe that although we provide this information to you freely, we are neither endorsing nor recommending any specific company. 2. Augusta Valuable Metals: Augusta Valuable Metals has a stable popularity for providing transparent pricing, customized customer support, and secure storage options. They are sometimes centered more on maximizing their earnings than offering high quality companies to prospects. 6. Customer support: An analysis of the supplier’s customer support, including their responsiveness, professionalism, and the quality of the assist offered. 1. Provider Background: Particulars concerning the gold IRA provider’s historical past, expertise, and status within the industry. 3. Storage Choices: Details about the storage amenities where the gold is held, including their safety measures, insurance coverage, and geographical locations. Gold Futures and Options: These monetary derivatives mean you can speculate on the longer term price of gold. 4. Investment Options: A list of the precious metals supplied by the provider, such as gold, silver, platinum, and palladium, along with their purity requirements and approved kinds (bars or coins). There’s an entire record of gold IRA reviews for each agency farther down. Usually, gold IRA companies provide buybacks because it is of their finest curiosity. However, most gold IRA companies may have requirements, and you have to work with and meet them.