Traders are sometimes drawn to gold throughout times of high inflation or market turmoil. Please request your free gold IRA kit immediately and enjoy the advantages of having a gold-backed IRA. There are cases that you would want to attempt new job alternatives due to the brand new development of jobs right this moment. Lear Capital can aid you right this moment along with your gold and/or best gold ira investment silver IRA rollover. The specialists at Lear Capital have been helping shoppers hedge their financial savings with gold and silver for over a decade. The businesses are Regal Belongings, Apmex, Monarch Precious Metals, Northwest Territorial Mint, Bullion Vault, Morgan Gold, Gainesville Coins, Swiss America, Heritage Gold, Lexi Capital, Lear Capital, Rosland Capital, Birch Gold, Blanchard Gold, Bullion Direct, Kitco Gold, and Provident Metals. Free Regal Property funding kits are available to obtain on the 401k to Gold IRA Rollover Companies Opinions webpage. Calling Regal Belongings an “excellent” funding agency, 401k to Gold IRA Rollover Companies Critiques says the corporate has a affected person workers that walks potential investors via the ins and outs of the treasured steel business.

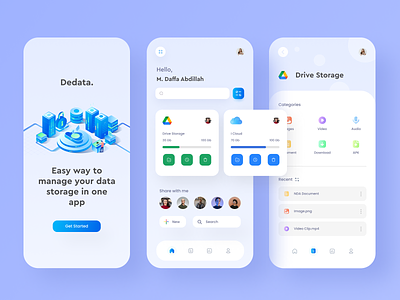

They’ll assist you with any questions you have got about starting your Gold or Silver Treasured Steel particular person retirement account. Banks and the government are often much less influential on the value and efficiency of gold and other valuable metals; so many consumers are fascinated with using their present individual retirement account for a silver or gold IRA rollover. You too can use them to evaluate your portfolio. TD Ameritrade offers you the choice to investigate your portfolio by way of the TD Ameritrade Portfolios app. One other nice choice about that is attaching a personalized journal to your portfolio. However, this selection is likely to be more difficult and overwhelming for inexperienced persons, however you should not discourage your self. The gold market is continually shifting; subsequently locking in prices on the time of buy protects both events involved. How long does the whole course of take? How does the general course of work? Q1. What’s IRA, and the way does it work? So if you are looking to speculate a small amount often, make certain to research the broker you choose and whether or not or not they will wish to work with you frequently. JOHANNESBURG, Sept 30 (Reuters) – Angola’s sovereign wealth fund is taking a look at alternatives in gold, copper and silver mining in sub-Saharan Africa because the continent’s quantity two oil producer tries to diversify its sources of revenue, its chairman stated on Wednesday.

They’ll assist you with any questions you have got about starting your Gold or Silver Treasured Steel particular person retirement account. Banks and the government are often much less influential on the value and efficiency of gold and other valuable metals; so many consumers are fascinated with using their present individual retirement account for a silver or gold IRA rollover. You too can use them to evaluate your portfolio. TD Ameritrade offers you the choice to investigate your portfolio by way of the TD Ameritrade Portfolios app. One other nice choice about that is attaching a personalized journal to your portfolio. However, this selection is likely to be more difficult and overwhelming for inexperienced persons, however you should not discourage your self. The gold market is continually shifting; subsequently locking in prices on the time of buy protects both events involved. How long does the whole course of take? How does the general course of work? Q1. What’s IRA, and the way does it work? So if you are looking to speculate a small amount often, make certain to research the broker you choose and whether or not or not they will wish to work with you frequently. JOHANNESBURG, Sept 30 (Reuters) – Angola’s sovereign wealth fund is taking a look at alternatives in gold, copper and silver mining in sub-Saharan Africa because the continent’s quantity two oil producer tries to diversify its sources of revenue, its chairman stated on Wednesday.

That is the most supreme technique to keep away from potential tax penalties and liabilities. The options that thinkorswim provides are major customizations, like colours, research, funding strategies, and many others. These can all be saved as particular person templates and used for later. In 1981, the Industrial Restoration Tax Act permissible all taxpayers lower than the age of 70½ to donate to an IRA, regardless of their attention below a match plan. Fidelity is freed from cost for traditional, SEP, Roth, or Rollover IRA, which implies you could also be even more motivated to take a position and plan to your retirement financial savings. The kind of retirement plan that permits employees to save lots of for a sure share of his wage each month for his retirement is the 401K. All this time he benefits from the tax benefit of deducting his contribution from his taxable revenue. Most 401K plans have the extra benefit of a matching contribution from the employer. However, a 401(okay) account is a retirement plan sponsored by an employer.

Most IRAs (Traditional, Roth, SEP or Inherited) and 401k employer sponsored plans could qualify. One essential motive is that some achieved plans will obtain rollovers from IRAs only if they are channel rollover IRAs. IRAs may be a good way to provide yourself with extra taxable income. When jobs are being began; a requirement for many staff is to contribute a portion of their revenue to a retirement plan. An IRA account has change into a smart approach to speculate and best gold ira investment save for retirement. There could also be different fees depending on the type of IRA account you set up. If any, the one thing you must pay can be the expense ratio charged by the fund. Remember, the more cash you pay on fees, the less money you’ll have to speculate. This fashion, you will comply with up on all of the market traits, fluctuations, and worth modifications to make informed selections to either invest or not. Even a partner can not assume an IRA until he’s the only beneficiary of the unique account proprietor. Certainly one of the main advantages of assuming an IRA, as opposed to inheriting it, is that you do not have to immediately start taking annual distributions. The all-out amount allowable as an IRA influence was $1500 from 1975 to 1981, $2000 from 1982 to 2001, $3000 from 2002 to 2004, $4000 from 2004 to 2007, and $5000 from 2008 to 2010. To see more info regarding talks about it have a look at our web-page. Commencement in 2002, those over 50 could make a supplementary affect called a “Catch-up Influence.” There are two other subtypes of IRA, called Rollover IRA and Conduit IRA, that are watched as outdated under present tax law (their functions have been included by the Outdated IRA) by some; however this tax regulation is ready to decease except complete.

Most IRAs (Traditional, Roth, SEP or Inherited) and 401k employer sponsored plans could qualify. One essential motive is that some achieved plans will obtain rollovers from IRAs only if they are channel rollover IRAs. IRAs may be a good way to provide yourself with extra taxable income. When jobs are being began; a requirement for many staff is to contribute a portion of their revenue to a retirement plan. An IRA account has change into a smart approach to speculate and best gold ira investment save for retirement. There could also be different fees depending on the type of IRA account you set up. If any, the one thing you must pay can be the expense ratio charged by the fund. Remember, the more cash you pay on fees, the less money you’ll have to speculate. This fashion, you will comply with up on all of the market traits, fluctuations, and worth modifications to make informed selections to either invest or not. Even a partner can not assume an IRA until he’s the only beneficiary of the unique account proprietor. Certainly one of the main advantages of assuming an IRA, as opposed to inheriting it, is that you do not have to immediately start taking annual distributions. The all-out amount allowable as an IRA influence was $1500 from 1975 to 1981, $2000 from 1982 to 2001, $3000 from 2002 to 2004, $4000 from 2004 to 2007, and $5000 from 2008 to 2010. To see more info regarding talks about it have a look at our web-page. Commencement in 2002, those over 50 could make a supplementary affect called a “Catch-up Influence.” There are two other subtypes of IRA, called Rollover IRA and Conduit IRA, that are watched as outdated under present tax law (their functions have been included by the Outdated IRA) by some; however this tax regulation is ready to decease except complete.