Position trading, a long-term trading strategy, offers investors the opportunity to capitalize on trends over weeks, months, or even years. Unlike day trading or swing trading, position trading requires a patient approach, aiming for significant gains over time. However, timing is crucial in position trading, as entering a trade at the right moment can significantly impact profitability. In this article, we’ll delve into the factors that influence the timing of entering a position trade and explore strategies to maximize returns.

Understanding Position Trading:

Position trading involves taking positions in assets with the expectation that they will appreciate over the long term. Traders typically analyze fundamental and technical factors to identify assets with strong growth potential. Unlike other trading styles, position traders are less concerned with short-term fluctuations and focus on the broader market trends.

Factors Influencing Timing:

Several factors influence the timing of entering a position trade:

Market Analysis:

Conducting thorough market analysis is essential before entering a position trade. This includes assessing the overall market trend, sector performance, and economic indicators. Position traders often rely on fundamental analysis to identify undervalued assets with strong growth prospects.

Technical Indicators:

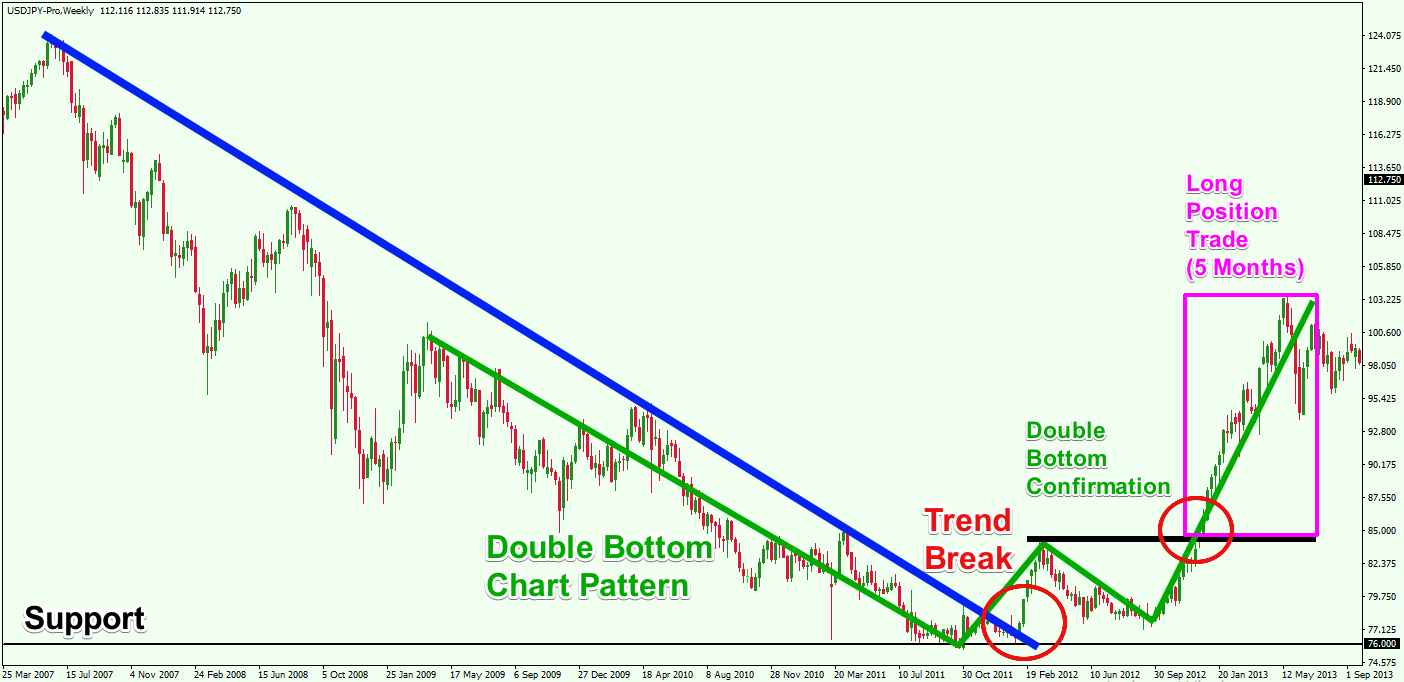

Technical analysis plays a significant role in timing position trades. Traders use indicators such as moving averages, MACD (Moving Average Convergence Divergence), and RSI (Relative Strength Index) to identify entry points. These indicators help traders gauge the momentum and strength of a trend, aiding in decision-making.

Support and Resistance Levels:

Identifying support and resistance levels is crucial for determining entry points in position trading. Support levels represent price levels where buying interest outweighs selling pressure, while resistance levels indicate price levels where selling pressure surpasses buying interest. Position traders often enter trades near support levels in uptrends and resistance levels in downtrends.

Economic Calendar Events:

Economic calendar events, such as interest rate decisions, GDP releases, and employment reports, can significantly impact asset prices. Position traders should be aware of scheduled economic events and their potential impact on the market. Incorporating this information into trading decisions can help avoid entering trades during periods of high volatility.

Risk Management:

Effective risk management is vital in position trading. Traders should determine their risk tolerance and set stop-loss orders to limit potential losses. Additionally, position sizing should be based on risk-reward ratios to ensure favorable risk-adjusted returns.

Best Times to Enter a Position Trade:

While there’s no one-size-fits-all answer to the best time to enter a position trade, certain conditions favor favorable entry points:

During Market Pullbacks:

Market pullbacks, or temporary reversals within an uptrend, present attractive entry opportunities for position traders. During pullbacks, asset prices may temporarily dip, providing an opportunity to enter trades at a lower price before the trend resumes.

After Confirmation of Trend Reversals:

Position traders often wait for confirmation of trend reversals before entering trades. This confirmation may come in the form of a breakout above resistance levels in uptrends or a breakdown below support levels in downtrends. Entering trades after confirmation reduces the risk of entering prematurely.

When Fundamentals Align with Technicals:

The convergence of strong fundamental and technical factors can signal optimal entry points in position trading. For example, if a company’s earnings report exceeds expectations, and technical indicators indicate a bullish trend, it may present an ideal opportunity to enter a long position.

Near Key Support or Resistance Levels:

Entering trades near key support or resistance levels enhances the probability of success in position trading. These levels often act as barriers to price movements and can provide favorable risk-reward ratios for traders.

During Low Volatility Periods:

Low volatility periods are characterized by stable price movements and reduced market fluctuations. Position traders may find it advantageous to enter trades during these periods as it minimizes the risk of sudden price swings.

When Risk-Reward Ratio Is Favorable:

Before entering a position trade, traders should assess the risk-reward ratio of the trade. A favorable risk-reward ratio ensures that potential profits outweigh potential losses, making the trade economically viable.

Join us and enhance your skills! Explore our wide range of courses and take your knowledge to the next level.

Conclusion:

Timing plays a crucial role in the success of position trading. By understanding market dynamics, conducting thorough analysis, and employing effective risk management strategies, traders can identify optimal entry points and maximize returns. While there’s no definitive formula for timing position trades, aligning with market trends, leveraging technical indicators, and considering fundamental factors can enhance the probability of success. Ultimately, patience, discipline, and a strategic approach are key to successful position trading.