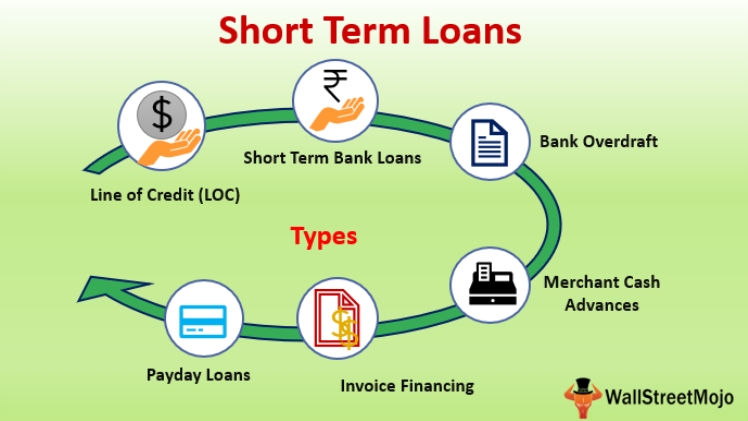

And if you have pristine credit, you would qualify for Short term loans a loan with an attractive interest rate. Name and ask the lender if you can lower your curiosity price, and if that doesn’t work, refinancing your loan could also be the most effective possibility for securing a decrease curiosity charge. Short term fund: Bank overdraft. U.S Financial institution has branches in 26 states: Arkansas, Arizona, California, Colorado, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Minnesota, Missouri, Montana, North Carolina, North Dakota, Nebraska, New Mexico, Nevada, Ohio, Oregon, South Dakota, Tennessee, Utah, Washington, Wisconsin and Wyoming. Wells Fargo doesn’t have department locations in Indiana, Kentucky, Louisiana, Ohio, Oklahoma, Maine, Massachusetts, Michigan, Missouri, New Hampshire, Vermont or West Virginia. New prospects will want to go to a branch location. An advantage could be that it helps kick begin Small Businesses that don’t earn a lot revenue and need extra employees or branches earlier than they’ll begin earning sufficient income nevertheless, a drawback can be that it’s quite a little bit of a pay again. Automobile age. An older vehicle can carry further danger of issues for each you and your lender. Make certain to think about the advantages and Short term loans drawbacks of each to make an knowledgeable and intelligent monetary decision.

And if you have pristine credit, you would qualify for Short term loans a loan with an attractive interest rate. Name and ask the lender if you can lower your curiosity price, and if that doesn’t work, refinancing your loan could also be the most effective possibility for securing a decrease curiosity charge. Short term fund: Bank overdraft. U.S Financial institution has branches in 26 states: Arkansas, Arizona, California, Colorado, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Minnesota, Missouri, Montana, North Carolina, North Dakota, Nebraska, New Mexico, Nevada, Ohio, Oregon, South Dakota, Tennessee, Utah, Washington, Wisconsin and Wyoming. Wells Fargo doesn’t have department locations in Indiana, Kentucky, Louisiana, Ohio, Oklahoma, Maine, Massachusetts, Michigan, Missouri, New Hampshire, Vermont or West Virginia. New prospects will want to go to a branch location. An advantage could be that it helps kick begin Small Businesses that don’t earn a lot revenue and need extra employees or branches earlier than they’ll begin earning sufficient income nevertheless, a drawback can be that it’s quite a little bit of a pay again. Automobile age. An older vehicle can carry further danger of issues for each you and your lender. Make certain to think about the advantages and Short term loans drawbacks of each to make an knowledgeable and intelligent monetary decision.

Earlier than applying for a building loan, consider these benefits and drawbacks. In case you plan to build a home, enhance your credit score rating earlier than applying for a building loan. Once you apply, the lender will request your paystub and banking info to make sure you’re employed and know the place to pull the funds from when it’s time to collect. Can the builder request a primary draw to pay for materials? Construction loans allow you to finance the materials and labor to construct a house from scratch – versus a conventional mortgage loan, which is just for accomplished homes. Except you pays out of pocket to build a new dwelling, you’ll want a building loan to finance the venture.

Earlier than applying for a building loan, consider these benefits and drawbacks. In case you plan to build a home, enhance your credit score rating earlier than applying for a building loan. Once you apply, the lender will request your paystub and banking info to make sure you’re employed and know the place to pull the funds from when it’s time to collect. Can the builder request a primary draw to pay for materials? Construction loans allow you to finance the materials and labor to construct a house from scratch – versus a conventional mortgage loan, which is just for accomplished homes. Except you pays out of pocket to build a new dwelling, you’ll want a building loan to finance the venture.

Or you possibly can apply for a bank card that gives zero % APR on purchases for a restricted time and pay it off earlier than the promotional interval ends. Make sure you repay what you spend before the due date rolls around to avoid accruing interest on these purchases. The platform does provide clients numerous different perks and discounts, Short term Loans together with unemployment safety and the ability to vary their payment due date once a 12 months. A whole lot of payday loan firms offer short term loans, nevertheless the phrases of the loan usually are not very favorable to the buyer. Very merely, the lower your credit score score is, the upper your interest rate can be. Some lenders publish the typical interest charge borrowers qualify for, short Term Loans but it may be essential to read buyer evaluations to see whether or not the typical borrower qualifies for competitive charges. Shop round for lenders. Nonetheless, some lenders might require the next credit score, so you’ll need to buy round and compare pointers.

However, a private loan may also assist your credit score score by improving your cost history (assuming you make your funds on time) and diversifying your credit score mix. Nonetheless, many lenders require extra-between 25% and 30% of the whole construction prices. This may enable you to slender down which lenders will likely be keen to work with you. Use a personal loan calculator to find out how a lot month-to-month payment you’ll be able to afford, after which go for the shortest possible loan time period. Critics of title loans contend that the enterprise mannequin seeks and traps impoverished people with ridiculous interest rates by lenders who aren’t entirely transparent relating to the payments. The one factor worse is a late payment, which is extra probably if you’re struggling to keep track of funds on a pile of maxed-out credit playing cards. Firms that grant loans and wish to track the repayment with QuickBooks can create an Other Asset account if the loan must be repaid over a interval of more than one 12 months. Loan firms do provide cash to unhealthy credit score holders regardless of CCJs, arrears, defaults, bankruptcy, IVA, foreclosure, late cost, and so on. So, get the loan quantity now and take pleasure in the very best financial service.