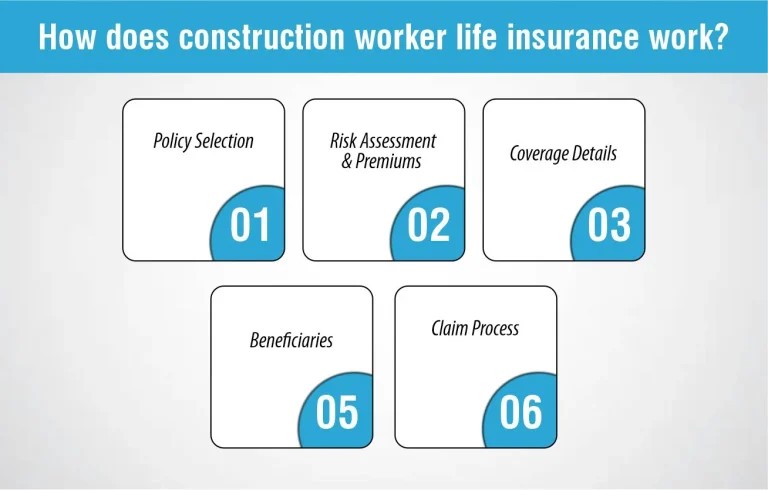

Life insurance is a critical financial tool for anyone, but it holds particular importance for those working in high-risk industries like construction. With the inherent dangers of the job, it’s essential for construction workers to secure their financial future and protect their loved ones in the event of an unforeseen tragedy. However, choosing the right type of life insurance can be overwhelming. In this guide, we’ll explore the best types of life insurance for construction workers to provide clarity and guidance in making this important decision.

- Term Life Insurance: Term life insurance is one of the most popular and straightforward options for construction workers. It provides coverage for a specific period, typically ranging from 10 to 30 years. During this time, if the insured passes away, the policy pays out a death benefit to the beneficiaries. Term life insurance offers high coverage amounts at affordable premiums, making it suitable for those with temporary needs, such as covering a mortgage or providing for children’s education. For construction workers, who may face higher risks on the job, term life insurance can offer valuable protection during their working years.

- Permanent Life Insurance: Permanent life insurance, such as whole life or universal life insurance, provides lifelong coverage as long as premiums are paid. Unlike term life insurance, which only offers a death benefit, permanent life insurance also includes a cash value component that grows over time. This cash value can be accessed during the insured’s lifetime through policy loans or withdrawals, providing a source of funds for emergencies or retirement. While permanent life insurance typically has higher premiums than term life insurance, it offers certainty and stability, which may appeal to construction workers seeking long-term financial security.

- Accidental Death and Dismemberment (AD&D) Insurance: Accidents are a constant risk in the construction industry, and AD&D insurance provides additional protection in case of accidental death or serious injury. Unlike traditional life insurance, AD&D policies pay out a benefit only if the insured’s death or injury is caused by an accident, such as a workplace incident. While AD&D insurance may not replace the comprehensive coverage of a standard life insurance policy, it can serve as a valuable supplement for construction workers concerned about on-the-job risks.

- Group Life Insurance: Many construction companies offer group life insurance as part of their employee benefits package. Group life insurance policies provide coverage to a group of individuals, such as employees of a particular company, and often have lower premiums compared to individual policies. While group life insurance can be a convenient and cost-effective option, it’s essential for construction workers to evaluate the coverage limits and portability of the policy. In some cases, group life insurance may not provide adequate coverage for individual needs or may be lost if the worker changes jobs.

- Key Person Insurance: For construction workers who own or manage their own businesses, key person insurance can be vital for protecting the company’s financial stability. Key person insurance provides coverage for the loss of a key employee, such as the owner or a top-performing worker, whose death could significantly impact the business’s operations and revenue. By ensuring that the company has the financial resources to weather such a loss, key person insurance helps safeguard the livelihoods of employees and the future success of the business.

Life insurance types for construction workers

In conclusion, life insurance is a crucial part of financial planning for construction workers, providing protection and peace of mind for themselves and their families. By understanding the various types of life insurance available, construction workers can make informed decisions that align with their needs and priorities. Whether opting for term life insurance during their working years or securing permanent coverage for lifelong protection, investing in life insurance ensures that construction workers can face the future with confidence, knowing that their loved ones will be taken care of no matter what.