NerdWallet recommends doing this, which implies that the examine from the 401(okay) can be made directly to your IRA as an alternative of you, which minimizes potential tax penalties. Every has quite a lot of providers and products to offer. Gold and Silver IRA Companies provide a number of approved precious metal products, such as bullion bars, coins, and rounds. Augusta Precious Metals is a household-owned firm that produces valuable metals. Many gold investors gravitate in the direction of treasured metals as a result of they might mitigate among the losses you expertise in your inventory or bond allocations throughout intervals of market volatility. It allows you to make every resolution about your account assets, allocation and redistribution, whereas also providing you with necessary tax advantages. While you may keep investing in either kind of IRA so long as both you or your spouse are employed, there’s additionally something known as minimum distribution that you’ll need to think about. Ought to your spouse have access to a retirement savings plan, you’ll be able to have a MAGI as much as $193,000 earlier than the deduction starts to phase out. Taxpayers with a retirement financial savings plan who file as single might have a MAGI as much as $64,000, whereas married taxpayers can have a MAGI up to $103,000 before their tax deduction for their IRA contribution starts to decrease.

NerdWallet recommends doing this, which implies that the examine from the 401(okay) can be made directly to your IRA as an alternative of you, which minimizes potential tax penalties. Every has quite a lot of providers and products to offer. Gold and Silver IRA Companies provide a number of approved precious metal products, such as bullion bars, coins, and rounds. Augusta Precious Metals is a household-owned firm that produces valuable metals. Many gold investors gravitate in the direction of treasured metals as a result of they might mitigate among the losses you expertise in your inventory or bond allocations throughout intervals of market volatility. It allows you to make every resolution about your account assets, allocation and redistribution, whereas also providing you with necessary tax advantages. While you may keep investing in either kind of IRA so long as both you or your spouse are employed, there’s additionally something known as minimum distribution that you’ll need to think about. Ought to your spouse have access to a retirement savings plan, you’ll be able to have a MAGI as much as $193,000 earlier than the deduction starts to phase out. Taxpayers with a retirement financial savings plan who file as single might have a MAGI as much as $64,000, whereas married taxpayers can have a MAGI up to $103,000 before their tax deduction for their IRA contribution starts to decrease.

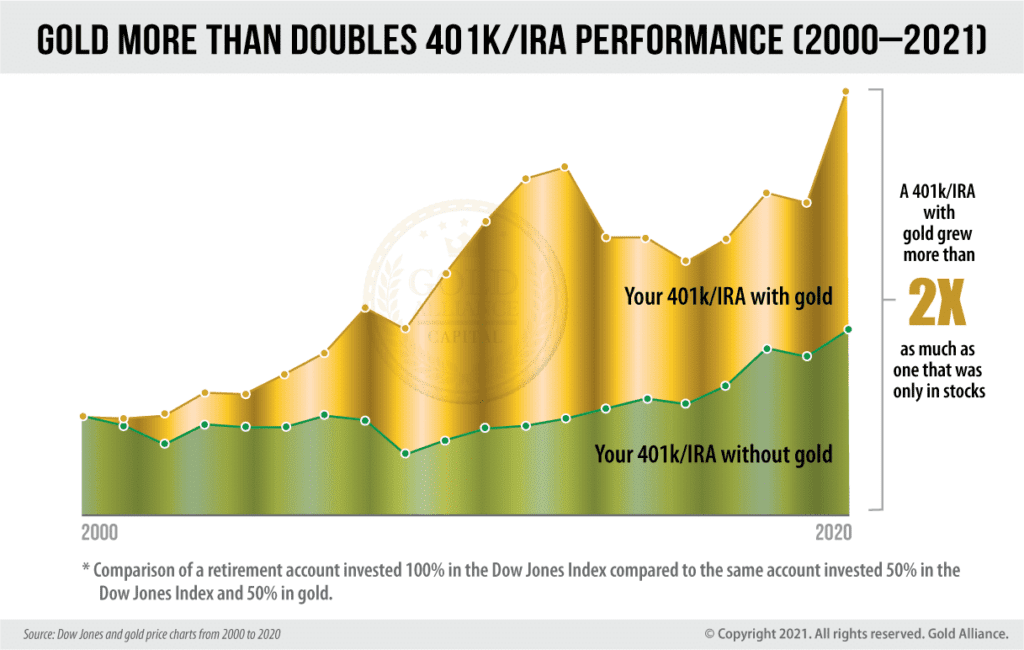

You may as well obtain a tax deduction on your revenue taxes. Understanding the differences between commercial actual property contract language or terminology is an obvious important step to being profitable in business actual estate investing. Understanding all of the distinctions is essential in deciding which IRA is the higher choice for you. When you loved this post and you wish to receive more info with regards to Dealeaphotography write an article generously visit the web-site. Deciding on an IRA: Traditional vs. But it helps to do your analysis first – from deciding how one can finest make your gold funding to buying the correct quantity and figuring out what to anticipate with regards to performance and best gold ira june 2023 growth. Gold IRAs can present diversification for the retirement funds you’ve gotten, protect your wealth, and Best gold ira June 2023 supply a stable asset with long-term progress potential. Once you arrange a Roth IRA, you make investments after-tax dollars and allow them to grow tax-free, which suggests that you won’t pay taxes on later withdrawals you make after a sure age. Gold’s attraction as a protected haven is one purpose the price tends to rise when the market suffers a downturn. Most often, each is for a hundred troy ounces of gold, and priced per ounce in U.S. You can buy bullion coins and bars in varied denominations, from a single gram to 400 ounces.

You may as well obtain a tax deduction on your revenue taxes. Understanding the differences between commercial actual property contract language or terminology is an obvious important step to being profitable in business actual estate investing. Understanding all of the distinctions is essential in deciding which IRA is the higher choice for you. When you loved this post and you wish to receive more info with regards to Dealeaphotography write an article generously visit the web-site. Deciding on an IRA: Traditional vs. But it helps to do your analysis first – from deciding how one can finest make your gold funding to buying the correct quantity and figuring out what to anticipate with regards to performance and best gold ira june 2023 growth. Gold IRAs can present diversification for the retirement funds you’ve gotten, protect your wealth, and Best gold ira June 2023 supply a stable asset with long-term progress potential. Once you arrange a Roth IRA, you make investments after-tax dollars and allow them to grow tax-free, which suggests that you won’t pay taxes on later withdrawals you make after a sure age. Gold’s attraction as a protected haven is one purpose the price tends to rise when the market suffers a downturn. Most often, each is for a hundred troy ounces of gold, and priced per ounce in U.S. You can buy bullion coins and bars in varied denominations, from a single gram to 400 ounces.

Silver coins include the Chinese language Silver Panda, the Canadian Maple Leaf, the Austrian Philharmonic, best gold ira june 2023 and the U.S. A reliable gold IRA company ought to be geared up to offer you a dependable buyback program. The depository is regularly audited by the depository and best gold ira june 2023 by an unaffiliated third celebration. As a Self-Directed IRA administrator we’re a neutral third social gathering. What charges are related to opening an account with a Gold IRA Company? Even if you’re already conversant in conventional investing in stocks and bonds, getting began investing in gold is usually a bit of a problem. This ease of use makes it extra convenient for you to manage your retirement investments. It’s one of the best investment companies for gold IRA’s alongside different precious metals shopping for options.